India’s Battery Energy Storage System (BESS) sector is primed for rapid expansion with funding opportunities projected to reach ₹3.5 lakh crore by FY32.

SBI Capital Markets estimates that capital expenditures in battery cell manufacturing will fuel an additional ₹80,000 crore in investments in the near term.

This momentum is expected to drive the development of both project-level and upstreaming investments consequently. Ultimately it will make India a global hotspot for BESS innovation and deployment.

Supportive Agreements and Risk Mitigation Strategies

Strong Power Purchase Agreements (PPA) and Power Sale Agreements (PSA) with credible distribution companies (Discoms) underpin the growth in India’s Battery Energy (BESS).

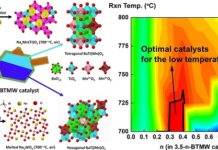

Tailored project models and, furthermore, advanced cell technologies are also central to this expansion.

Competitive tariffs effectively manage risks such as battery price declines and the shift to higher-capacity batteries. Additionally, Discoms’ current Energy Storage Obligation (ESO) and Renewable Purchase Obligation (RPO) goals, aligned with project lifespans in existing PPAs, further mitigate these risks.

Manufacturing Surge and Capital Expenditure

Battery manufacturing is expected to drive substantial capital expenditure as both established and emerging players ramp up their production capabilities.

Technological advancements are spurring mergers and acquisitions for creating valuable opportunities for companies aiming to scale up their operations in the energy storage space.

Variable Renewable Energy

India’s push toward a Variable Renewable Energy (VRE) future is forecasted to triple VRE’s share in electricity generation by FY32.

The country expects its growth in storage capacity twelvefold to reach 60 GW by FY32.

They project renewable energy tenders to incorporate storage at a significantly higher proportion, increasing from 5% in FY20 to 23% in FY24.

Dominance of BESS

BESS and pumped storage projects (PSP) are on track to dominate nearly 100% of the energy storage market.

BESS will lead in flexibility and efficiency, while PSP will crucially aid in peak shaving and grid stabilization.

PSP offers longer operational lifespans, low operating costs and minimal e-waste impact, making it a valuable complement to BESS.

By FY32, they expect BESS capacity to reach 47 GW, with PSP capacity projected to quadruple to 19 GW.

Focus on Reducing BESS Tariffs

Reducing BESS tariffs hinges on domestic battery cell manufacturing and a reliable component supply chain.

At present, battery cells and components account for 80% of BESS costs with most cell production concentrated in China.

To address this dependency, the Indian government’s Production-Linked Incentive (PLI) scheme for Advanced Cell Chemistry. Additionally, It aims to establish 55 GWh of new capacity.

Key players in the sector have already announced plans for nearly 120 GWh and expect to meet this demand over the next several years.

Future Outlook

With robust policy support, advanced manufacturing, and rising investments, India is positioning its BESS ecosystem to meet the country’s renewable energy storage demands. It supports its transition to a low-carbon economy.

As reported by thehindubusinessline.com, the sector’s growth could have a transformative impact. India’s energy landscape setting a new standard for energy resilience and sustainability.