Abstract

There is no doubt that decarbonization will be very challenging. But there is no escape from it and a strong start needs to be made from now. There are several decarbonization avenues available as explained in this comprehensive article. Some can be implemented in a short time while others would need fundamental changes from selection of feedstocks to the chemistries to the entire manufacturing chain requiring very long time frames. Very scientifically planned, well directed and smartly executed routes are possible, though some of it would be challenging. Transformation to a low carbon industry can be painful in the short term but it can result in significant medium and long term opportunities and benefits.

Introduction

Worldwide, production of primary chemicals emits about 1 billion tons of CO2 annually. If we include emissions from hydrogen production for ammonia, the total primary chemical industry emissions increase to about 1350 million tons of CO2, or about 2.5% of total annual global greenhouse emissions.

Adding emissions from upstream activities related to petrochemicals in oil & gas, downstream production of organic and inorganic chemicals, and emissions post-use disposal of chemical products, the total emissions from the global chemical industry is over 3 billion tons of CO2 per annum.

Compared to other prominent industries with similar emissions (textiles, for instance), the chemical industry has been under less scrutiny and pressure thus far on the decarbonization front.

But the scenario is changing fast. Globally, as well as in India, the key chemical industry stakeholders are beginning to take note.

Decarbonization challenges

This review and analyses will focus on decarbonization for the primary chemicals sector.

Of the total direct emissions from the primary petrochemicals industry, about 500 million tons can be attributed to ammonia production alone. Further, 210 million tons are from the production of ethylene, 125 million tons from methanol production, 110 million tons from the production of polypropylene, and about 40 million tons from the production of benzene/toluene/xylene (BTX). Hydrogen production from natural gas, used mainly as a feedstock for ammonia production, results in an additional 350 million tons of annual CO2 emissions.

Ammonia is produced using the Haber Bosch process. Ethylene and polypropylene are produced through cracking of fossil hydrocarbon feedstock. Methanol is produced from syngas which in turn is derived from natural gas. Most hydrogen is currently produced from natural gas through a steam reformation process.

A large portion of the CO2 emissions happen owing to the use of fossil sources for heat energy required for these thermochemical reactions. In addition to these energy related emissions, there are significant process CO2 emissions from the chemical reactions for hydrogen production – these happen owing not to fuel use for energy but from the thermochemical processes that produce hydrogen.

Heat is the dominant form of energy used in the chemical industry production setup, with electricity currently playing only a minor role. The heating infrastructure is configured for use of fossil fuels – mainly natural gas and oil. The processes for producing hydrogen, ammonia and the other basic chemicals are well established and their infrastructures highly invested into.

None of the above emissions is easy to abate.

Decarbonization roadmap 2020-2030 – dimensions

Given that significant changes need to be implemented at various points in their value chains for many industries, rapid decarbonization for many industries will take place only during the 2030-2050 period. This would be even more true for hard-to-abate industries such as petrochemicals.

However, a strong start needs to be made during the 2020-2030 period that can provide some modest short term successes but more importantly, build a robust platform for significant decarbonization post 2030.

What could be the roadmap for such a start? Analyses along the following dimensions could be useful to arrive at it.

●Decarbonization avenues – A comprehensive list of low carbon or zero carbon alternatives available for the industry

● Stakeholders – Key decarbonization stakeholders within and outside the industry

● Strategic intent – Tactical and long-term low carbon objectives

Decarbonization avenues

The following represent the decarbonization avenues available for the chemical industry.

● Energy & resource efficiency – The chemical industry has been continuously implementing efficiency and emissions control measures for many decades across its value chain. Even in the context of greenhouse gas emissions, the industry has made significant progress in reducing N2O emissions from adipic acid and nitric acid production. The new thrust on CO2 emissions reductions can provide new opportunities for the industry to become more energy and resource efficient. Significant potential for further improvements exists through the use of digital tools such as predictive analytics, advanced visualization tools, and AI-powered energy management applications. New technologies – such as those for low grade waste heat recovery – could be explored.

● Green hydrogen – Given that the current method of hydrogen production from fossil natural gas constitutes a significant portion of the total industry emissions (about 350 million tons per annum), zero carbon hydrogen will be valuable to its decarbonization efforts. Green hydrogen produced through water electrolysis powered by renewable energy will help in CO2 emission reductions in chemical and many other hard-to-abate industries. Given the added potential that green hydrogen has as an energy storage medium for electric transport, large-scale green hydrogen infrastructure is likely to be built worldwide during the next ten years, and this will significantly benefit the chemical industry’s decarbonization endeavours.

● Use of renewable sources for heating – Most heating in the chemicals industry uses fossil fuels, mainly natural gas and oil. Directly using renewable sources such as biomass could be difficult for these applications. Instead, replacing natural gas with a drop-in substitute such as renewable natural gas could ensure that the industry is able to abate heating related CO2 emissions quickly. Renewable natural gas is already being produced in many parts worldwide from biomass waste and organic waste such as food waste, though this sector is yet to prove that it can scale.

● Electrification of heating – About 40% of the industry emissions are from the use of energy for heating purposes. Electrification of heating for primary chemicals production could lead to significant CO2 emissions when the electricity is supplied from renewable sources such as solar or wind power. Possibilities are even being explored in which the reaction processes themselves are converted into an electrochemical process from the current thermochemical processes. Interestingly, while renewable electrification benefits chemical production, chemicals can also provide benefits to renewable electrification by offering a medium (through hydrogen or ammonia, for instance) to store their intermittent energy generation. Renewable electrification is thus quite an attractive avenue, but implementation will be challenging owing to significant R&D to make the whole process efficient and economical, the large capital investments to be made by the industry, and also the need for a large-scale electricity storage infrastructure for continuous use of solar or wind power, both of which are infirm.

● Recycling or reuse of products – Another avenue by which the industry can reduce emissions is to produce less in the first place, or produce from a non-virgin, semi-processed raw material that requires much less energy for production compared to that from virgin feedstock. The former can be achieved through reuse or repurposing of chemical based products (especially plastics) and the latter through effective recycling processes. This avenue has significant positive implications for long-term sustainability of the industry, but both recycling and reuse/repurposing have still not scaled significantly enough, though some regions (Germany, for instance) have done much better than others. Besides, the chemical companies in themselves do not have much control over recycling and reuse of the end products made downstream.

● Low carbon waste feedstock – These typically refer to the waste feedstock used to make chemicals or fuels. Unlike recycling, which restores the product to its original form or converts it to a related product, this avenue uses feedstock such as plastic waste and other organic waste to make oil through processes such as pyrolysis. This oil becomes a low carbon drop-in raw material feedstock for chemical production, in place of crude. For instance, Dow Chemical in 2021 partnered with Fuenix Ecogy Group in The Netherlands to supply pyrolysis oil feedstock made from recycled plastic waste. While this avenue appears more attractive compared to the intricate and tedious recycling process, challenges exist on dimensions such as logistics and co-opting the downstream producers.

● Bio-based alternatives – Bioplastics are an obvious example of fossil feedstock being replaced by a renewable feedstock embodying much less net carbon compared to synthetic plastics. While bioplastics still contribute only about 1% of total plastics production worldwide, their contribution is likely to be much larger in future given the significant environmental harm from conventional plastics. All the same, the first half of 2020-2030 (until about 2025) is likely to see only gradual growth in the use of bioplastics and other bio-based alternatives owing to the niggling performance issues and unfavourable economics.

● CO2 capture & utilization – If industries have to reduce CO2 emissions to the atmosphere much faster than what all of the above would permit, why cannot they explore capturing the emitted CO2, and subsequently either store it or utilize it to make other products? Such capture and/or utilization could be especially relevant for hard-to-abate industries. CO2 has been used on scale for urea production and for enhanced oil recovery, but it needs to be used in many other applications to make a real contribution to abatement. This is an exciting area of research and piloting currently, as it has the potential to provide abatement at scale as well as new business opportunities for many stakeholders (think CO2 based chemicals, fuels, concrete…). The 2020-2030 period will likely see significant investments in this field by many stakeholders, though large-scale commercialization might happen only post 2030.

Current status & potential for the decarbonization avenues

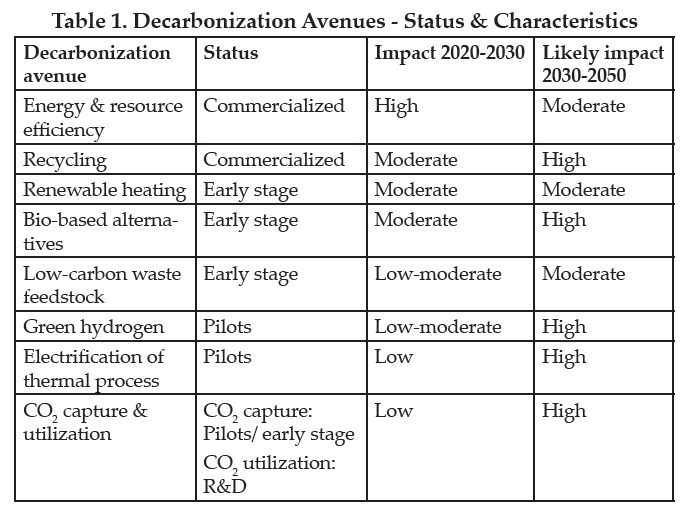

There hence exist a number of decarbonization avenues for the chemical industry. But each carries its own benefits and constraints. It is thus important for the industry to have better clarity on the status and decarbonization potential that each of these avenues presents.

To enable this, for each avenue, a brief summary is provided on current status and its likely impact on decarbonization for two periods: 2020-2030 and 2030-2050.

The key takeaway from the above summary is that the chemical industry has the opportunity to achieve moderate reductions for the present while they eye much higher reductions in future.

The key takeaway from the above summary is that the chemical industry has the opportunity to achieve moderate reductions for the present while they eye much higher reductions in future.

Decarbonization stakeholders

During the next three decades, almost every industry is likely to undergo dramatic transformations in their efforts towards low carbon value chains. Such a transformation will involve and engage many participants in each industry – from the top management all the way to the blue collar worker.

For the 2020-2030 period however, some stakeholders will be playing far more important and decisive roles for decarbonization efforts than most others. For an industry such as the chemicals sector, the key stakeholders for the 2020-2030 period are:

● Top management of medium and large chemical companies

● Corporate researchers, scientists & engineers

● Government & policy makers

● Financial investors

● Academic & university researchers

● Technology & solution vendors

● Entrepreneurs & startups

Strategic intent

We now have identified the main decarbonization avenues and the key industry stakeholders. How can the stakeholders strategize on these avenues for the 2020-2030 period?

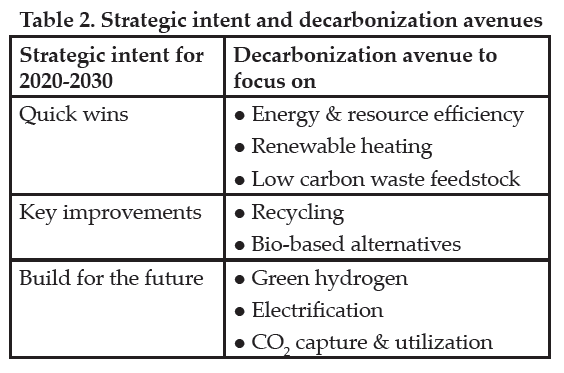

One effective template would be to use strategic intents. Three such intents can be considered:

● Quick wins – These are decarbonization wins that the chemical industry can achieve in the short and medium term through smart process tweaks and intelligent use of digital technologies to drive efficiencies

● Key improvements – These are more difficult than the quick wins, and some of them may not be in the direct control of the industry. But with strategic investments and partnerships, the industry may be able to achieve moderate decarbonization by 2030 based on efforts with this strategic intent.

● Build for the future – These comprise strategies needed to support massive transformations – be they for technology, process or feedstock. The full benefits of these will be available only post 2030. The industry should however utilize the 2020-2030 period to experiment, learn and build capabilities and partnerships to benefit from these in future.

Acting on the decarbonization avenues

Given the nature, characteristics and potential of each of the decarbonization avenues, how can these be prioritized along strategic intent and for each stakeholder group?

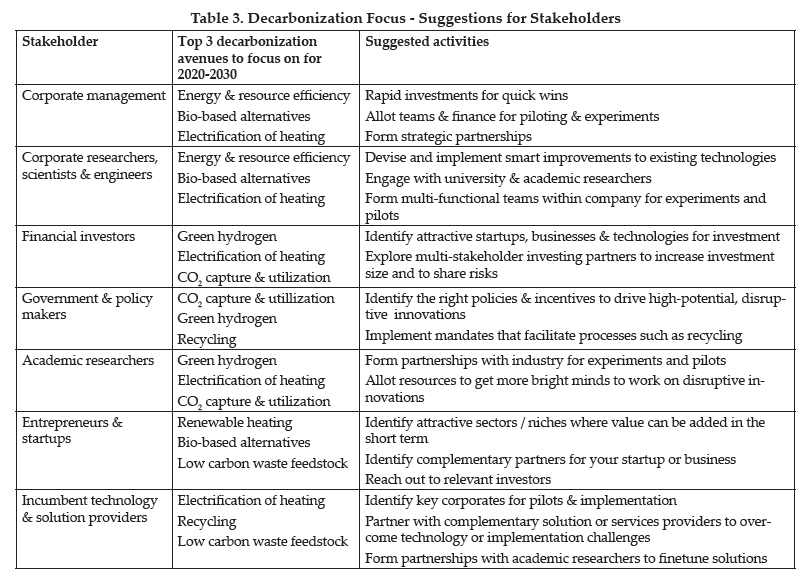

Stakeholder groups and decarbonization avenues

Stakeholder groups and decarbonization avenues

Which of the decarbonization avenues should each stakeholder group focus on during the 2020-2030 period? The following, brief analysis could help.

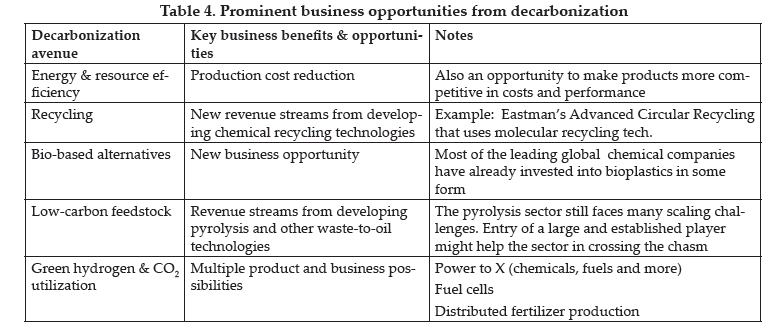

Decarbonization is a challenge…and also an opportunity

It is only natural for most industries to initially view decarbonization as something that is thrust upon them.

But as captains of many industries are realizing, while the transformation to a low carbon industry can be painful in the short term, approaching it with the right mindset could result in significant medium and long term opportunities and benefits.

But as captains of many industries are realizing, while the transformation to a low carbon industry can be painful in the short term, approaching it with the right mindset could result in significant medium and long term opportunities and benefits.

Opportunities emerging from decarbonization is too large a topic to do justice in a short review such as this, but here are some interesting take-aways for chemical companies from decarbonization.