Honeywell finalized acquisition of Sundyne from private equity firm Warburg Pincus in a $2.16 billion all-cash transaction, marking another bold step in its strategic expansion. Industry experts recognize Sundyne as a leader in highly engineered pumps and gas compressors for critical process industries. Honeywell expects the acquisition to immediately boost its sales growth, segment margins, and adjusted earnings per share (EPS) in the first full year of ownership.

Enhancing Capabilities in Refining, LNG, and Clean Fuels

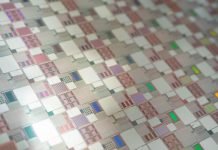

Sundyne’s industry-leading products, technology, and strong customer relationships will significantly enhance Honeywell UOP’s value chains across refining, petrochemicals, liquefied natural gas (LNG), and clean and renewable fuels. Integrated into the Honeywell Forge platform, the combined offerings will deliver a scalable, end-to-end industrial solution—positioning Honeywell at the forefront of the global energy transition.

Strategic Fit for Energy and Sustainability Growth

“The acquisition enables us to provide better, more comprehensive solutions for our customers,” said Ken West, President and CEO of Honeywell’s Energy and Sustainability Solutions (ESS) segment. “By merging Sundyne’s differentiated product lineup with Honeywell’s cutting-edge technology and R&D expertise, we’re unlocking powerful synergies and setting the stage for significant business growth,” added West.

Part of a Broader Strategic Realignment

The Sundyne acquisition follows Honeywell’s broader transformation strategy, which includes the planned spin-offs of its Aerospace Technologies and Solstice Advanced Materials businesses. These moves aim to create three distinct, publicly listed entities, each with focused growth strategies and market leadership positions. Since December 2023, Honeywell has committed over $13.5 billion to value-accretive acquisitions to drive organic growth and streamline its portfolio.

Recent Deals Signal Growth-Focused Agenda

In addition to Sundyne, Honeywell has made several high-impact acquisitions, including:

*Access Solutions business from Carrier Global

*Civitanavi Systems

*CAES Systems

*LNG business from Air Products

*Catalyst Technologies from Johnson Matthey

At the same time, Honeywell is actively pruning its portfolio, having recently sold its Personal Protective Equipment business to Protective Industrial Products.

A Stronger, More Focused Honeywell Emerges

The Sundyne acquisition is now complete. Honeywell continues to reshape itself into a leaner, innovation-driven enterprise. It is positioning to lead in energy, sustainability, and industrial technologies. As per the company press release, its ongoing investments and portfolio adjustments reflect a clear commitment to long-term growth. They also demonstrate a strong focus on enhancing shareholder value and leading the global energy transition.