Introduction

The ability to create new and specialized forms of chemistries to address a wide range of applications through frugal engineering, strong consumer understanding, and world-class R&D, backed by a large pool of highly skilled engineers and scientists of high calibre, India is very well poised to play an important and bigger role in the global specialty chemicals industry.

The $800 billion global specialty chemical market that has been growing at a CAGR of around 5.7% over the last five years is expected to keep the growth momentum at around 6% and become a $1 trillion market by 2025. Specialty chemical is a part of the larger global chemical sector that is today valued at around $4 trillion, which has grown at a CAGR of around 4% between 2004 and 2018.

Today, the global chemical sector is dominated by China with a market share of around 35% followed by Europe and the US with a share of around 20% and 15%, respectively. So far India has been an emerging player in this global chemical sector with a market share of around 3%. However, within the global chemical industry, specialty chemicals are emerging as a major vehicle for growth, particularly for Indian manufacturers that are expanding both products and capacities over the last few years.

What are the specialty chemicals?

The world of chemicals can be broadly classified into two large categories — basic and special. Basic chemicals are essentially commodities that are manufactured at a large scale to cater to a wide range of applications and/or global demands. These are generally considered relatively lower in the value chain and find use in everyday life such as fertilizers or base detergents etc. Specialty chemicals on the other hand are compounds that are low volume but very high-value chemicals, created by a combination of two or more chemicals or value extracted from one of the commodity chemicals, and these address specific needs such as agrochemistry, personal care ingredients, water chemicals, construction chemicals, pharma intermediates or enhancing the bio-availability of nutrients in food ingredients, etc.

On a gram to gram comparison, specialty chemicals deliver more value for the producer and consumer. For example, zinc oxide in its basic or commodity form has multiple applications such as paints, cosmetics, foods, etc. The same compound produced in its micronized form becomes nano zinc oxide that has special applications with its antiviral and anti-fungal properties and therefore fetches much higher value. While zinc oxide is sold in the market for anywhere between Rs 250 and Rs 500 a kilogram, in its nano form (nZnO) its value can go up to Rs 3500 to Rs 5000 a kilogram, given the sharp differentiation that Science and nano-

Technology delivers, depending on its application.

Globally, specialty chemical has been growing at 5.7% CAGR over the last five years and is an $800 billion industry and is expected to grow at around 6% and become a $1 trillion industry by 2025. Today China, backed by technology, innovation, and massive production capacity is the leader in this sector. For the last two decades or so, China has grown in the specialty chemical industry from a global market share of just 6% in 2000 to 35% in 2019.

India, the rising star

With a total value of around $32 billion in turnover, specialty chemicals constitute around a fifth of the larger Indian chemical industry that valued at around $163 billion as of FY18.

According to recent market research, this segment of the Indian chemical industry is expected to double to around $65 billion over the next five years by growing at around 12% against mid-single-digit growth of the global market around the same period.

A recent research report by ICICI Direct, the growth from the domestic specialty chemical industry would largely be addressed by sub-sectors like agrochemical, surfactants, aroma chemicals, plastic additives, water treatment chemicals, etc.

The optimism around the growth potential of the Indian specialty chemical sector is grounded on several tangible factors:

a) Low-cost manufacturing base

The lower manufacturing cost, impressive process engineering skills, and the abundance of killed engineers are now propelling India to emerge as a major player in the specialty chemical industry. That apart, India is also an export-oriented country and is growing faster than other countries in this space.

b) Strong domestic market

As the world’s second most populated country, the domestic market itself is a strong growth driver for specialty chemicals in India, both in terms of volume and value. In many ways this is very similar to what China had experienced over the past two decades thanks to the growing disposable income, rapidly increasing urbanization, and growth in consumer sectors such as paints, textiles, adhesives, and homecare products.

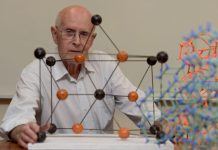

c) Strong depth in R&D

Success in the specialty chemical industry is largely dependent on R&D (leading to innovation). A lot of this is happening in Europe and the US, but at a very high cost. The ability of India’s frugal engineering, combined with the amazing mind of scientists here and in no small measure linked to the government-funded institutions of national importance like CSIR labs has created a broad-based skill pool in the country which we can tap into to able deliver better and sharper value in R&D and innovation.

d) Sustainable chemistry

This is another unique strength that India has and can be the magic sauce that can differentiate us in the global specialty chemical industry. While the world is jogging in this direction, India has the skills and capabilities for the marathon to deliver ‘green chemicals’ capable of delivering value in the form of long-term sustainable chemistry solutions.

Success within the specialty chemicals segment which is directly tied to finding new applications largely depends on the R&D spend of key players in the market. In fact, the success of China that has seen it emerge as the world’s largest source of specialty chemicals is also due to its massive investment in R&D. Between 2008 and 2018, the annual R&D spend by China jumped nearly fivefold from Euro 2.5 billion to Euro 11.8 billion, that led to its higher share in exports from 8 to 13%, while exports from other major markets like EU, US and Japan dropped. Between 2008 and 2018, the R&D spend by Indian chemical companies also doubled from around Euro 700 billion to Euro 1.4 billion, though the share of global exports remained stagnant at 2%.

Driven by application

The growth and diversification opportunities of specialty chemicals are mainly driven by increasing applications in daily lives both for industrial and consumer sectors. Specialty chemicals are finding vital applications in primary sectors including agriculture and animal nutrition and also in construction, food & nutrition, glass, high-performance rubber, metals, oral care, cosmetics, paints, inks and adhesives, pharmaceuticals, soaps & detergents, textiles & leather, lithium-ion, dry cell, and other batteries.

Within the larger chemical sector, and in terms of volume, specialty chemicals (compared to commodity or basic chemicals) account for a relatively smaller share of the pie. The wide range of possible applications is what makes specialty chemicals a much-sought segment by large manufacturers across the world. This is also the reason why chemical manufacturers are willing to invest a significant part of their budgets in research and development, which again focuses on new and exciting applications across both agricultural, industrial, and consumer markets.

The role of specialty chemicals in agriculture addresses two basic needs which are higher productivity or yield and better and more effective crop protection. In traditional agrarian economies like India, due to the indiscriminate use of irrigation water and fertilizers, a large part of the country’s agricultural land has become degraded. The use of micro-irrigation techniques and fertigation is the only way to manage these resources efficiently. Chemical manufacturers today can offer a range of specialist solutions which provide micronutrients and growth inputs for a healthy crop.

Similarly, refined sodium bicarbonate is ideally suited for poultry feed and diet for dairy animals. It is of particular value as a non-chloride source of sodium in poultry diets.

Bicarbonate is also essential for strengthening eggshell quality under intensive production systems. When added to diets for dairy animals, sodium bicarbonate effectively counters the acidity of silage and cereal-based concentrates, maintaining feed pH at its optimum level.

India is also a large market with high growth potential in the crop protection industry that is backed by its diverse agro-climatic conditions and impetus to grow agricultural productivity.

India’s capability in low-cost manufacturing, availability of technically trained resources, seasonal domestic demand, overcapacity, better price realization, and a strong presence in generic pesticide manufacturing are the major factors that are boosting the growth of crop-care chemicals.

A decade ago there was a growing demand to replace organic UV blockers which are widely used in paints, cosmetics, and various applications. However, organic UV blockers suffer from harmful side effects and poor durability when applied to other materials. Developing zinc oxide as an effective alternative came out of this inheritance and emerging demand. Out of this came the need to create a version of zinc oxide which retains its primary properties but can be used in applications like paints, polymer, cosmetics, etc. This led to the creation of nano zinc oxide (nZnO), which is today finding critical applications as an effective coat on face masks and other personal protection equipment in the global fight against COVID-19. The demand for nZnO is also rapidly expanding into new applications including textiles that come with a pre-coated protective layer of this specialty chemical.

Today we also have specialty grade silica that can be used in coating applications with improved rheology control and high-performance properties such as matting effect, improved surface finish, abrasion-resistant. It can be used in epoxy resins and adhesive application as thickening agent & rheology modifiers, and also help improve abrasion resistance and mechanical strength of end applications. Silica works as an excellent reinforcement filler for paper pulp, coating additive for surface smoothness which imparts stability of printing inks on papers.

Specialty chemicals are the new IT

For many years, the focus of manufacturing in India has largely been around manufacturing sectors like auto, steel, etc. linked to nation-building that was also largely focused on domestic consumption. For example, if real estate was booming all the applications were also focused on real estate e.g. – steel, cement, etc. Now over the last few years, we are focused on making India the hub for manufacturing for the world, born out of the Make in India mission.

We have also realized the need to broad-base our capabilities and become a manufacturing hub for a wide range of products and services. This three-decade-long trajectory has taken us from becoming a centre for manufacturing excellence in auto, steel, etc. to financial services, ITeS (IT-enabled services), etc. Today we have realized that we have reached the saturation point in these industries and therefore the need to look at new sectors like specialty chemicals that offer huge potential for reasons stated earlier.

Over the last decade or so, a few large chemical companies in India have already committed serious capital in multi-location R&D/innovation centres and capacities. New opportunities are also emerging for CRAMS (contract research and manufacturing service) for Indian companies which are backed by the desire to lower our dependency on imports, particularly chemical intermediaries. Agrochemicals, consumer durables, APIs (Active Pharmaceutical Ingredient), and pharma are some of the large consumers of specialty chemicals that will provide huge opportunities for the Indian chemical sector both within the domestic and global markets (exports). If India continues to invest in R&D/innovation and capacities at a global scale powered by a relatively lower cost of manufacturing, the specialty chemicals business is perfectly poised to deliver what the IT/ITeS sector did over the last three decades.