India is grappling with substantial hurdles in its drive toward India’s renewable energy targets as highlighted in a recent report by Zero Carbon Analytics. Despite setting an ambitious target to achieve 500 GW of non-fossil fuel capacity by the early 2030s, progress remains slower than needed to meet this goal.

Investment Falling Short of Demand

In 2023, India’s renewable energy attracted $12.4 billion investments, but this sum pales in comparison to the estimated $200 billion required to meet its clean energy targets. To reach 500 GW of non-fossil fuel capacity, the country must add 300 GW of renewable energy within this decade. However, the pace of new additions has been insufficient. Between 2022 and 2023, they installed only 13 GW, with another 20.7 GW added from January to September 2024.These figures fall short of the 50 GW annual benchmark necessary to stay on track.

Surging Electricity Demand Increases Urgency

Compounding these challenges is India’s rapidly growing energy demand. According to Neelima Jain, Director of State Initiatives at the International Energy and Climate Center (IECC), electricity demand in India grew by 7% in 2023—more than triple the global average of 2.2%. This surge pushed peak demand from 182 GW in 2019 to 250 GW in 2024, marking an annual growth rate of 6.5%. With evening demand spikes placing additional strain on the grid, the need for dependable energy solutions is more pressing than ever.

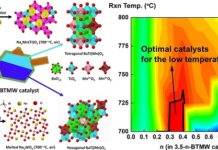

Battery Storage as a Key Solution

Battery storage has emerged as a critical solution to balance India’s renewable energy generation with demand surges. Recent auctions in Gujarat and SECI have seen co-located storage costs decline to $150 per kW, driven by global trends of reduced material costs and overcapacity in Chinese production. Analysts predict an additional cost reduction of 15-20% by 2030, potentially making battery storage a financially viable alternative to coal.

“Battery storage in India could be a game-changer,” said Jain. “If we don’t accelerate storage deployment, we’ll be forced to rely on coal to meet growing demand, which could lead to stranded assets. It’s crucial that the 41 GW of firm capacity currently under construction is completed on time, and that storage deployment becomes a priority at both national and state levels.” Accelerating storage deployment could help mitigate the risks of coal dependency, especially with rising energy needs.

Overreliance on Imported Materials

India’s dependence on imports for key materials also hampers its renewable energy transition. China dominates the global solar photovoltaic (PV) module market, controlling nearly 80% of it, while India’s share was under 2% in 2022. India primarily imports critical minerals like lithium, cobalt, and nickel, emphasizing the need for a robust, domestic supply chain.

The wind sector shows more resilience, with India producing 70-80% of its turbines domestically. However, in solar PV, reliance on imports remains a bottleneck. For India to secure its renewable future, experts recommend developing a self-reliant supply chain and prioritizing the recycling of components from solar and wind technologies. This approach could create a sustainable cycle for future manufacturing and reduce dependence on imported resources.

A Strategic Pivot Needed

The report by Zero Carbon Analytics underscores that India must focus now on scaling up storage solutions and developing a resilient domestic supply chain. Without strategic investments and policy interventions, rising energy demand could risk locking India back into coal reliance, jeopardizing its clean energy ambitions.