Abstract

As everyone knows chemical industry is one of the most complex industries. It handles thousands of diverse materials from benign to the most hazardous. The industry also needs apart from raw materials various kinds of equipment and accessories made of different materials in varying sizes.

All these make the procurement function in the chemical industry very challenging. This article outlines these issues and the potential of digitalization to address these challenges.

Introduction

The chemical industry today is a forerunner to the growth trends of a host of interdependent sectors in the manufacturing ecosystem. The role of the CPO in a critical sector like chemical goes beyond the apparent cost reductions and stability of material sourcing. The new-age CPO in the chemical industry needs to accept supply chain complexities, vendor consolidation, and innovations in packaging and distribution to tap the tremendous growth potential in the sector.

The opportunity in the chemical sector is red-hot, and India finds itself in an enviable position to cash in due to our geo-location advantage, tremendous demand from developed markets, and the global shift away from Chinese vendors amid policy change and lockdown unpredictabilities. According to a McKinsey report on the sector, the Indian chemical industry has outperformed global benchmarks regarding total return to shareholders (TRS). Since 2014, the compound annual growth rate (CAGR) for TRS in India has been 15%, double the global average, and remained steadfast even in the economically weak period of 2016-19.

Bridging the Divide: Challenges at the doorstep of chemical procurement leaders

The procurement supply chain in the chemical sector has a unique set of complexities compared to the industry average. This makes the life of procurement officers challenging, and simultaneously demands innovation and efficiency.

The ever-broadening scope of the supply chain

Chemical procurement leaders need to look at a host of ancillary products along with core production and raw materials. Due to the nature of chemicals and corrosion, there is a tremendous demand for replacing infrastructural elements, such as pipes, valves, and flanges. Chemical handling complexities create a need for specialized lab equipment, safe transportation, and storage options. This varied demand leads to a bloated supplier list and the need to manage multiple mini supply chains in tandem. Vendor consolidation and tracking are good tools for procurement officers to have.

The complexities of vendor management

With many specialized vendors, organizations will face challenges of timing, logistics costs, dependability and quality. Transportation of materials is a crucial challenge. Material and human safety, temperature control and safety of packaging are essential to smooth operations. The general tendency is to prioritize local vendors for high volume requirements; hence monitoring vendor performance and helping them overcome issues of credit and transportation become critical for large procurers. Real-time tracking and predictability of bottlenecks alleviate these procurement challenges.

Need for innovation and stability in packaging

As every chemical industry CPO will attest, spillage continues to be a significant concern for every industry player. Due to the hazardous nature of chemicals, storage and transportation is very complex and need specialized training to manage. While glass is the primary choice of storage due to its excellent properties, it is also brittle and prone to breakage. Other alternatives like plastics, metal drums and large volume containers are suitable for certain materials, making the packaging material’s choice very critical.

A shift in global procurement trends

India has evolved into an attractive investment destination for downstream chemical opportunities. Several global oil and gas manufacturers expect an increased focus on petrochemicals in India to enable specialty material production. With China’s tighter regulations and financing challenges, prominent Indian players should seize the initiative by increasing self-reliance and production capacities. India’s proximity to the Gulf region – the world’s primary supplier of petrochemical substances – puts us at a unique advantage in consolidating a larger global market share. Again, the CPO needs a robust end-to-end procurement platform to help navigate international policy and multi-vendor management.

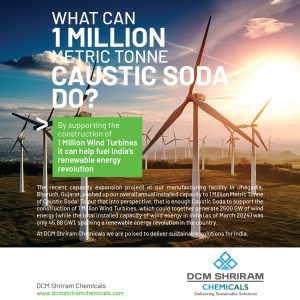

A positive shift towards sustainability

End consumers are increasingly veering towards a positive brand image by compliance with sustainability guidelines in materials and distribution. Procurement chiefs have to navigate these demands by encouraging innovation in raw material sourcing and ensuring supplier compliance and new-age packaging solutions. Innovation requires agility as the nature of procurement could change based on supplier location and pricing considerations. Sustainability is the future and could soon become a higher prioritization parameter than even price.

The advent of digital transformation in the chemical industry

Though the chemical industry is no stranger to digitalization, the pandemic has accelerated the adoption of innovation-led technologies, including but not limited to remote operation centers, industry 4.0, robotics, and autonomous operations in warehouses and logistics. As per the 2020 survey of industry executives by EY, 66% of leaders in the chemical industry expect revolutionary and disruptive effects in digitalization to double and triple, respectively, within the next three years, leaving no business function behind.

Going back to the pre-pandemic model seems like a far-fetched thing now that greater cost-efficiencies are achieved through optimized supply chains and collaboration tools brought on by technology-enabled abilities and insights. A recent McKinsey survey of the European Chemical Industry showed that about 55% of buyers of petrochemical products would prefer to adopt digital channels if efficient and value-adding platforms were available. The share is even higher for specialty channels, with about 82% of customers willing to adopt digital platforms.

The development of a successful digital platform is not an overnight job. It needs a lot of consideration and understanding of the current customer demands along with an overarching digital strategy that focuses on culture, technology, talent, and business processes. Meticulous market research of customer metrics and the problems that need to be addressed also falls under this radar. Digitalization has tangible advantages for procurement supply chains:

- Vendor consolidation and management

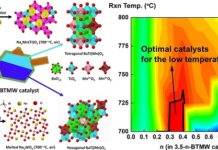

- Catalog-based, AI/ML-based purchasing to get the best price

- Vendor quality monitoring and improving benchmarks of timeliness, loyalty and logistics efficiency

- Flexibility in vendor selection and a plan B approach to logistical breakdowns

- End-to-end dashboards for visibility and course corrections ensure a seamless customer experience.

- Access to data at all supply chain linkages ensures better communication and reporting for the benefit of all stakeholders.

How Indian companies tap the latent growth potential in the chemical industry and global focus on India can shape the economic outlook for our GDP. Procurement leaders need solutions to the most pressing challenges to unlock new revenue streams and insulate organizations from market fluctuations.