Abstract

Separation and filtration technologies play a crucial role in the oil and gas industry by enhancing efficiency, meeting regulatory standards, and reducing environmental impact. Advanced filtration systems improve hydrocarbon extraction, emissions control, and wastewater treatment, driving innovation and sustainability in the sector.

Introduction

Over the last decade, the global market for separation and filtering technologies has expanded at an exponential rate. The root cause for this expansion is the growing need for accuracy, adherence to environmental regulations, and operational effectiveness across multiple industries. The petrochemical sector is still one of the largest contributors in this industry. Most of the petrochemicals are derived from crude oil and natural gas. Therefore, advanced filtering systems are needed to extract hydrocarbons and remove the contaminants. Petrochemicals constitute 14% of the total oil demand and 8% of the entire natural gas demand, demanding the employment of highly effective separation techniques in the handling and purification of inputs.

The International Energy Agency (IEA) predicts that by the end of the decade, the world’s oil consumption is projected to level off as a result of a rapid shift to sustainable energy technologies, reaching about 106 million barrels per day (mb/d). This is also supported by the increased use of jet fuel and feedstocks from the expanding petrochemical industry.

Regulatory Requirements and Technologies Revolutionizing the Industry

There are several regulatory requirements in the sector such as the United States Environmental Protection Agency (EPA) has implemented the Clean Water Act which regulates wastewater discharge from oil and gas operations. Similarly, the European Union has given a directive on the geological storage of carbon dioxide where they have set strict requirements for the capture, transportation, and storage of CO2 emissions from oil and gas operations.

According to the EPA, the emissions by the industry form 15% of the global emissions. The International Energy Agency (IEA) predicts the sector could emit 20% of greenhouse gases by mid-century. Meanwhile, the EU said that 60% of oil and gas companies violate its CO2 storage directives. To meet these guidelines, the sector will have to spend $150 billion on pollution control technologies by 2030, while improved separation and filtration could decrease emissions by about 30 %.

To reduce greenhouse gas emissions, businesses are inclining more towards incorporating carbon capture technologies in the filtration systems. For instance, in carbon capture filtration systems, post-combustion capture (PCC) systems are used to capture CO2 from the flue gas emissions from the oil and gas operations. The pre-combustion capture (PrCC) systems are used to capture CO2 from fuel gas emissions from oil and gas operations. In crude oil refining filtration systems, H2S removal filtration systems are used to remove H2S from the crude oil streams.

Also, mercaptan removal filtration systems are used to remove mercaptans from crude oil streams. In natural gas processing filtration systems, anime filtration systems are used to remove CO2 , H2S, and other impurities from natural gas streams. Similarly, glycol filtration systems are used to degas the natural gas streams by removing the water and other contaminants. In drilling and completion fluids filtration systems are also used to remove suspended solids, bacteria, and other contaminants from drilling fluids and completion fluids. Membrane filtrations including gas separation membranes are widely incorporated in methods in oil/water phase separation, hydrogen collection, and natural gas decontamination.

Industry Insights

In today’s world, strategies for reducing emissions, and meeting the standard set by contemporary laws are being explored. There are examples that demonstrate the same. Shell (UK) produces blue hydrogen by integrating advanced membrane systems with Carbon Capture & Storage (CCS). Similarly, the industry’s transition to low-carbon and renewable hydrogen production is highlighted by Air Liquide’s (France) projects that use hollow fibre membranes. It has received a US$ 113 million European Innovation Fund grant for its ENHANCE project in Antwerp-Bruges, Belgium that will establish Europe’s first industrial-scale renewable ammonia cracking plant and hydrogen liquefier.

Several companies and brands are innovating in the separation and filtration technology market in the oil and gas sector such as Schlumberger (USA) where they are developing advanced separation and filtration solutions, including that of membrane technologies and electrostatic precipitators. Halliburton (USA) has been offering a range of separation and filtration technologies such as centrifuges and decanters. Siemens (Germany) has been developing advanced technologies in the same sector such as electrostatic precipitators and fabric filters. Veolia (France) has been providing advanced separation and filtration technologies including membrane bioreactors and advanced oxidation processes. Frames (Netherlands) is also working on membrane technologies and electrostatic precipitators.

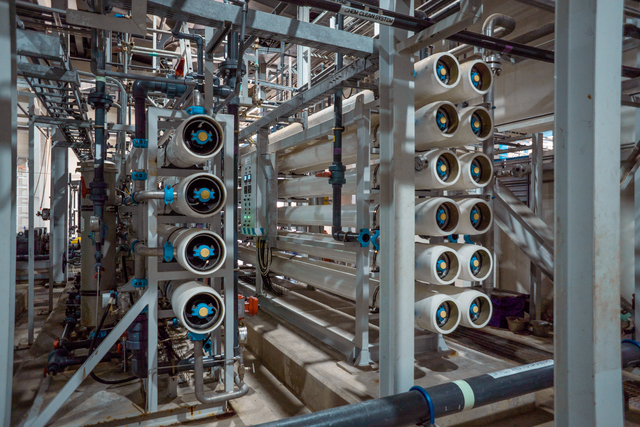

Separation and filtration technologies are critical to hydrogen production and mainly involve filtration processes such as the use of polymer electrolyte membranes (PEM). Green hydrogen, which is generated through electrolysis, and is obtained from renewable electricity, relies on reverse osmosis (RO) systems, activated charcoal filters, or palladium-based membranes in order to filter the water and separate the hydrogen gas. Blue and grey hydrogen produced by means of steam methane reforming (SMR) use H₂S & CO₂ removal filters, gas scrubbers as well as dryers for H₂ quality improvement, but the grey hydrogen does not include carbon capture, so it results in higher emissions. In the case of brown hydrogen produced from biomass or fossil fuel gasification, the tar removal filter removes tar content while the particulate filter removes particulate content. The scrubbers or abatement system removes sulphur content. These enhanced filtration systems not only purify the hydrogen more effectively but also contribute towards reducing the environmental impacts on the use of hydrogen as clean energy.

Leading markets and Regional Insights

Regional differences in resource availability, regulatory frameworks, and industrial growth all affect the demand for robust filtration technology. Filtration system investments have been fuelled by the Asia-Pacific region’s fast industrialization and rising energy demands in nations like China, India, and Indonesia. By giving pollution control and refining capacity improvements a priority, these countries are fostering a thriving market for cutting-edge technologies.

In terms of both technical investment and adoption, North America, and particularly the United States, continues to occupy a dominant position. Talking about the EU region, they are currently overhauling their climate policies with the coming of the European Green Deal in the climate legislation. In an effort to meet tough emissions reduction targets, most of the refineries and petrochemical firms in the region have installed carbon capture and storage (CCS) technology in their filtration systems. Since the Middle East and Africa are among the largest producers of oil in the globe, they are focusing on improving downstream functions like water treatment, gas treatment, and desalting of crude oil. Increasing oil and gas activities in Africa provides filtration companies the opportunity to introduce tailored offers considering infrastructural constraints.

Materials Used in Filtration Systems and the Need for Replacement

Metallic filters are widely used in the oil and gas industry for various applications, including wellhead filtration, downhole filtration, surface filtration, and more. These filters are known to be of high strength and are very durable, and are also immune to high temperatures and pressures and they are chemically inert. They can be made with respect to the particular filter characteristics and are classified into wire mesh filters, perforated plate filters, sintered metal filters, and metal fibre filters.

The use of polymeric filters in the oil and gas industry has continued to rise because of the peculiar characteristics and benefits associated with them. These filters are also light in weight; resistant to corrosion; possess good chemical characteristics and can be developed as per customer needs. They also cost less compared to metallic filters out in the market. Polymeric filters are of different categorizations; they include polypropylene filters, polyethylene filters, polyamide filters, and polyester filters. It is applied in various ways such as in treating produced water, surface, downhole, and wellhead filtration.

The use of ceramic membranes for the treatment of oily wastewaters includes silicon carbide, zirconium oxide, and aluminum oxide. These materials offer high flux, chemical resistance, and durability, but high sintering temperatures and expensive precursors remain problems for these materials.

As they are resistant to heat and chemicals, high performance polymers like PTFE, PVDF, polyamides, etc, are very important in hostile environments. Due to an increasing number of concerns for sustainability, natural polymers such as cellulose and chitosan, which are biodegradable and relatively cheap compared to synthetic materials, are being widely used.

Ceramic and metallic filters have been used in the oil and gas industry, but of late polymeric filters have been the trend. This trend is a result of the benefits such as; cost reduction, corrosion issues, low density, and performance enhancement. Polymeric filters also show better corrosion properties thus it will not easily wear out. They also weigh less and therefore are easy to manoeuvre as well as transport from one location to the other. Further, polymeric filters can be developed based on these polymer properties to achieve better filtration efficiency than conventional filters, as well as longer service life.

Future Outlook

Polymeric filters are seen to dominate the future market due to further developments in materials science and technology. Nonetheless, metallic filters will still sell within the market mainly for high-end uses. In the future, there will be improvements in the filtration field of the oil and gas industry due to the modifications of the appropriate materials and designs that will fulfill higher performances, less cost, and environmental impacts.