Abstract

Sustainability has become the most important philosophy for success in business and industry, and a deciding criteria for customers and investors alike.. Several international energy and chemical companies have aligned their corporate sustainability goals with the UN’s SDGs. Many are making progress towards formulating and executing well-thought-out strategies to improve and manage sustainability proactively.

Introduced in 2015, the UN Sustainable Development Goals (SDGs) represented an agenda for sustainable development. While very general, the goals outlined the aim to achieve a better and more sustainable future for all. With UN Resolution 70/1, the UN General Assembly established 2030 as the target year for achieving the following sustainable development goals (Table 1).

United Nations Sustainable Development Goals

United Nations Sustainable Development Goals

Across industry, sustainability is now front and center for customers and investors alike. Several international energy and chemical companies have aligned their corporate sustainability goals with the UN’s SDGs. Many are making progress towards formulating and executing well-thought-out strategies to improve and manage sustainability proactively. Leading industrial companies such as ExxonMobil, Dow, Saudi Aramco, and Shell have publicly announced somewhat different sustainability approaches.

ExxonMobil, for example, has articulated a commitment to producing the energy and chemical products that are essential to modern life, economic development, and improved standards of living and for protecting people, the environment, and the well-being of communities near its operations; and to employ advanced technologies to improve the sustainability of its current businesses. Dow is collaborating with like-minded partners to advance the well-being of humanity by helping lead the transition to a sustainable planet and society. Dow, one of the world’s leading materials science companies, has expressed a commitment to using science-based solutions and acting collaboratively to help lead the transition to a more sustainable society, employing a circular economy paradigm. Shell’s sustainability approach is built on a foundation of safe, efficient, responsible, and profitable operations. According to Shell, it will strive to produce and deliver energy responsibly, and in a way that respects people, their safety and environment. At the simplest level, this means “doing no harm,” and involves a portfolio shift toward renewables.

Saudi Aramco’s approach involves pushing the limits of creativity and technology to drive down the carbon intensity of energy products. To this end, the company is increasing research into new, carbon-neutral feedstocks to provide meaningful solutions to the energy and climate challenges.

Saudi Aramco’s approach involves pushing the limits of creativity and technology to drive down the carbon intensity of energy products. To this end, the company is increasing research into new, carbon-neutral feedstocks to provide meaningful solutions to the energy and climate challenges.

Sustainability Goes Beyond Environmental, Social, and Governance

People and organisations outside the industry want to better understand how the energy and chemicals sectors are evolving. This includes the impact of these sectors’ activities on people and the environment and the associated risks, opportunities, and trade-offs. One of the ways companies respond to these requests is through corporate reporting, specifically non-financial, environmental, social, and governance (ESG) reporting. ESG criteria provide a set of standards for a company’s operations that socially conscious investors use to screen potential investments.

The environmental criteria considers how a company performs as a steward of nature. Social criteria examines how it manages relationships with employees, suppliers, customers, and the communities in which it operates. Governance criteria considers factors such as transparency of reporting on sustainability progress, embedding sustainability culture throughout an organisation, reporting on how investor dollars are applied, and how an organisation manages its data to protect customers and minimise cyber risk. Sustainability, however, is broader than ESG and extends to meeting the business and other needs of the present, but without compromising the ability to meet the needs of future generations.

Parties in the supply chain – suppliers as well as customers – are also refining their expectations of transparency. Purchasing tenders now often integrate sustainability as a pre-qualification item. High qualityreporting can make the difference in gaining valuable contracts from companies that have similar values. Companies can also mitigate supply chain risks of poor social and environment practices by encouraging transparency throughout their procurement processes.

Based on ARC Advisory Group’s Research

During the first half of 2020, ARC Advisory Group conducted research to gain a better understanding of the current state of sustainability and “green initiatives” in the chemical and energy industries. Specifically, we wanted to learn where companies are focusing their efforts, what challenges they face, and ultimately, how they believe digitalisation and other technologies can advance their sustainability initiatives.

The research findings show that 90 percent of global energy and chemical companies have sustainability initiatives in place. In general, the sustainability initiatives at energy companies focus on the transition to a lower carbon future, while chemical companies focus these initiatives on producing more sustainable products. In other words, products that meet the increasing customer demand for a more circular economy, with increased recycling and reuse of products and materials. For both industry segments, improving operational safety also plays a vital role, since for many companies this is part of the license to operate.

Government regulation and mounting consumer pressure are driving the investment in sustainable products and lower-carbon energy through carbon taxes, fuel standards, and a ban on single-use plastics. In addition, one of the world’s largest investment firms, BlackRock, with nearly $7 trillion under management (including huge stakes in leading industrial manufacturing and energy companies), recently announced that sustainability issues would be at the center of its investment strategies moving forward.

Key findings relative to sustainability initiatives include:

- Lack of capital and resources and aging assets are top barriers to meeting sustainability objectives

- Customer buying preference drives company sustainability programs and access to capital

- Improving operational safety is a key element of most sustainability initiatives

- Digitalisation plays a key role in ensuring progress in meeting sustainability objectives

Importance of Digital Transformation to Achieve Sustainability Goals

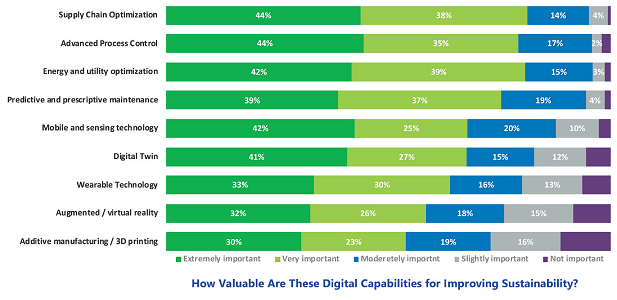

ARC believes digital transformation spans industrial products, operations, value chains, and aftermarket services. It augments people and knowledge through expanded use of sensors, data, and analytics. Most industrial process companies globally will undergo a digital transformation to some degree or other, with many already actively using technology to improve both business and environmental performance and sustainability. Digital enablement of new business models and finding new ways to bring products or services to market is a key capability in sustainable manufacturing. Below are findings from ARC’s survey (Fig 1).

How Valuable Are These Digital Capabilities for Improving Sustainability?

Seventy-five percent of survey respondents believe digital transformation is extremely important or very important for achieving sustainability goals. The following digital capabilities were ranked in order of their importance to improve sustainability:

- Supply chain optimisation to coordinate, manage, and improve the transparency of connected processes across different organisational silos; and coordinate processes to improve supply chain demands or product customisation and satisfy customer needs for sustainable products.

- Advanced process control (APC) to reduce process variability, minimise costly product giveaway, optimise processes against constraints, and support autonomous operations (wherever appropriate). APC based optimisation can also coordinate multi-unit dynamic process optimisation to help close the gap between plan versus actual production.

- Energy and utility optimisation using process modeling and simulation technology to improve the process design, optimise energy efficiency andprocessing, and improve maintenance.

- Predictive and prescriptive maintenance to improve asset utilisation and return on capital by use of machine learning and advanced analytic s to shift maintenance operations to predict failures and avoid process disturbances and equipment downtime.

ARC’s interviews with industry leaders revealed that operations management systems are a high priority. Human reliability and knowledge management through state-based control and other approaches have greater importance in the context of sustainability objectives. Product waste and energy losses often occur when workers do not have a good grasp on procedures and operational competency. For example, performing process startups, shutdowns, or other critical activities require established procedures that tie back to the experience level of workers and the operations management systems in place.

ARC’s interviews with industry leaders revealed that operations management systems are a high priority. Human reliability and knowledge management through state-based control and other approaches have greater importance in the context of sustainability objectives. Product waste and energy losses often occur when workers do not have a good grasp on procedures and operational competency. For example, performing process startups, shutdowns, or other critical activities require established procedures that tie back to the experience level of workers and the operations management systems in place.

Barriers to Meeting Sustainability Objectives

In general, the larger the company, the better its capability to pursue sustainability objectives aggressively. Because hypothetically at least they have more resources to devote to those objectives. However, several people we spoke with indicated that funding decisions are made at the board level at larger companies, and many board members might not have clear insights and visibility to properly address sustainability. This is especially true given the age of much of the asset base in the energy and chemicals industry.

The majority of infrastructure for heavy industry was designed and builtwithout sensitivity to sustainability goals or the development of more recent business models. In fact, most facilities were built prior to digital technology, and are designed principally around operational philosophies that date back to the 1980s. Unfortunately, it is not reasonable to think that industry will somehow change overnight or be supple enough to react to even the simplest of outside pressures for sustainability concerns. Older plants or facilities typically lack the base of sensors, instrumentation, and digital systems needed to optimise efficiency. The justification for modernisation can be difficult, and the conversion and installation process usually must be completed during a turnaround or shutdown.

The economics of driving complex change into highly energised and potentially dangerous assets that need to run at high levels of reliability are challenging. Owner operators in general, and field operations, are often very resistant to change, whether upgrading manufacturing assets or introducing digitalisation, because when they introduce change, they also need to go through a rigorous engineering design process to ensure integrity.

Management of change (MOC) processes tend to stifle innovation for sustainability, creating a huge gap between what the head office people think is possible and desirable versus what field operations people think is possible and desirable. Head office staff such as IT, central engineering, or other centralised project or improvement type roles are constantly exposed to vendor conferences and information sources that form their perspective about what is possible. Workers in the field, however, often do not receive that same exposure to information. This gap between what field personnel understands about digital innovation, versus what the home office understands creates an additional barrier to improving sustainability.

Chemical companies are preparing for a customer driven trend for stronger and more sustainable materials for the auto industry. This changes market strategy with differentiating products. The physical properties of what is sold is of greater importance now; specifically, how physical properties satisfy the need for re-usable products and products which are ‘circular’ in their ability to be re-used in a supply chain. The increased use of recycled resins can create a dilemma for automotive designers. There is a growing initiative to increase recycled materials content in products globally, and traditional methods of recycling polymeric materials in both thermoplastics and thermosets can lead to degradation of engineering, mechanical, processing, and/or aesthetic properties of the resin. In an era where product quality rules, this situation forces designers to accept a much lower percentage of recyclate than they might otherwise wish to use or risk unacceptable property loss in molded parts. This is something no automaker can afford. Hence, a valuable feed stream of materials (polymers) often ends up destined for a landfill once many consumer products are broken down and more easily reusable or recyclable materials are repurposed.

To help address the increasing pressure they face from the investment community and energy consumers, energy companies, in turn, are focusing on how they can continue to meet the world’s energy demands, while transitioning to wind, solar, geothermal, hydro, and other renewable and non-polluting energy sources.

Conclusion

Clearly, sustainability within the global energy and chemical industries is a multi-faceted concept that encompasses more than just environment, safety, and governance. Overall business sustainability through operational excellence and margin optimisation remain important objectives. In addition, due to the differing challenges each of those industries face, each has a somewhat different objective and focus for its sustainability initiatives.

While the vast majority of global energy and chemical companies have sustainability initiatives in place, based on ARC research, it appears that the sustainability initiatives at energy companies focus largely on the transition to a lower carbon future via increased use of wind, solar, hydro, geothermal, and other renewable energy sources; while chemical companies tend to focus their sustainability initiatives on developing and producing more sustainable, circular products characterised by low-carbon footprint and extensive use of renewable and/or recycled raw materials that can support reusable and/or recyclable end products for customers. For both industry segments, improving operational safety also plays a vital role, since, for many companies this is part of the license to operate. And for both industry segments, digital transformation is seen as an important enabler for business and ESG sustainability. A combination of regulatory pressures, customer pressures, and pressures from the investment community are forcing energy and chemical companies to move forward with their respective sustainability initiatives.