The Indian Fragrances and Flavours Industry, valued at $500 million, comprises SMEs, large Indian firms, and MNCs. It’s integral to the global supply chain, excelling in natural ingredients and unique scents. With 15% projected growth, India competes favourably, leveraging its diverse resources and R&D capabilities. Emerging opportunities lie in natural flavours, sustainable fragrances, and expanding exports to diverse markets globally.

There are global shifts taking place towards nature based ingredients. Creation of new products needs result oriented R&D.

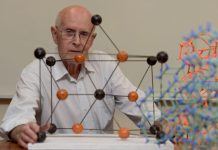

To understand the developments in this industry, Chemical Industry Digest interacted with Rishabh C. Kothari, CEO of CKC Fragrances, whose views to our questions are presented here.

Q 1. Chemical Industry Digest (CID): What is the market size of the industry for flavours and for fragrances or combined? What exactly are the sub segments in each? What is the market structure/ratio i.e. SMEs, large Indian companies and MNCs? To what extent is Indian FAFI part of the global supply chain in raw materials as well as finished products?

Rishabh Kothari (RK): The market size of the flavours and fragrances industry in India is dynamic and influenced by various factors. As of the latest available data, the combined market size is estimated at $500 million. The industry is divided into sub-segments such as flavours, fragrances, essential oils, and aroma chemicals. In the flavours segment, sub-categories include natural flavours, artificial flavours, and nature-identical flavours. In fragrances, the sub-segments involve personal care, home care, and fine fragrances.

The market structure includes a mix of SMEs, large Indian companies, and multinational corporations (MNCs). While SMEs contribute significantly to the market, both large Indian companies and MNCs play crucial roles, bringing innovation and international standards to the industry. The ratio can vary, but on average, SMEs constitute about 60%, large Indian companies 30%, and MNCs 10%.

Indian Fragrances and Flavours Industry is an integral part of the global supply chain, contributing both in terms of raw materials and finished products. The industry is known for its sourcing of natural ingredients and its capability to meet international quality standards.

Q 2. CID: FAFI is one of the fastest growing industries in India and globally. Can you give a brief summary of the growth percentages earlier, now and what it will be in future? How does our industry compare with similar industries in other countries, and in particular, with China? What are our strengths compared to overseas competition for flavours as well as fragrances? Are Indian companies known only for the traditional perfumes? Is the Indian perfumery industry good at creating unique ‘smells’ or “odours”?

RK: The flavours and fragrances industry in India has experienced robust growth over the years. The growth percentages have been impressive, with a historical average of 12%, and the current growth and projections for the future estimate a growth rate of 15%, showcasing the industry’s continued upward trajectory.

Compared to similar industries globally, the Indian Fragrances and Flavours Industry holds its ground, competing favourably with countries like China. India’s strengths lie in its diverse natural resources, traditional perfumery expertise, and the ability to create unique and culturally resonant fragrances. The industry is not limited to traditional perfumes; it has expanded its portfolio to cater to various applications, including personal care, home care, and food flavours.

Q 3. CID: What are the growth drivers in each sub segment like for essential oils, oleo products, aroma chemicals etc. What is the split between natural (or plant based) and synthetic or chemical based ingredients?

RK: The growth drivers vary across sub-segments. Essential oils are driven by the demand for natural products, while aroma chemicals are influenced by innovations in synthetic compounds. The split between synthetic and natural ingredients is approximately 60:40, although there a growing preference for natural and plant-based ingredients in specific applications.

Q 4. CID: Worldwide, there is an accelerated shift towards plant or nature based ingredients particularly where the end use is personal care, food processing etc. How does the Indian industry compare?

RK: The global shift towards nature-based ingredients is reflected in the Indian Fragrances and Flavours Industry. There is a growing emphasis on sustainable and eco-friendly practices. Indian companies are adapting by incorporating more plant-based ingredients, aligning with global trends in personal care, food processing, and other applications.

Q 5. CID: What about the technology strengths of Indian companies? To what extent are they based on indigenously developed know-how vs imported? Has the Indian industry developed through R&D new ingredients / products indigenously? How good is our R&D in this sector? I understand that a dedicated R&D Centre is to be set up in Mumbai exclusively for FAFI. Where has it reached? Can you elaborate on its funding and how member companies can do the R&D and able to gain access to R&D? Which of our research institutes are adept at R&D for the FAFI industry?

RK: Indian companies have demonstrated substantial technology strengths, leveraging both indigenously developed know-how and imported technologies. Research and Development (R&D) efforts have resulted in the creation of new ingredients and products.

The dedicated R&D Centre and Testing Laboratory in Navi Mumbai has already been set up by the Fragrances and Flavours Association of India (FAFAI) and is a significant step toward fostering innovation and collaboration within the industry. The centre was exclusively funded by the Association and now offers advanced testing and evaluation facilities to its members.

Moving forward we hope that member companies gain access to R&D through partnership programs, promoting knowledge sharing and collective progress.

Q 6. CID: Looking to the future, what are the growth opportunities for the Indian industry? Which sub-segments should the Indian industry concentrate on? What are the opportunities in exports, and to which geographical destinations?

RK: The future holds promising opportunities for the Indian Fragrances and Flavours Industry. Key sub-segments to concentrate on include natural flavors, sustainable fragrances, and innovative aroma chemicals. Export opportunities are abundant, especially to emerging markets and regions with a growing middle-class population. Geographical destinations for exports include developed countries of Europe and North America and the developing economic powerhouses in Latin America, Africa and Central and South Asia due to the increasing demand for diverse and culturally relevant flavors and fragrances.