Abstract

Phosgene, despite being a highly toxic chemical, is industrially an important chemical as its derivatives find myriad applications in many industries. However, its toxicity and fear of any fallout limits its applications. There is also the danger of its misuse due to dual use possibility in chemical weapons. Therefore, manufacturers have to ensure not only its safe usage in production but also ensure only allowed enduse as per the terms in the Chemicals Weapons Convention.

This article outlines the basic process of phosgene manufacture and some of its major derivatives as well as its market potential.

Phosgene, also called carbonyl chloride, is a colourless chemical compound produced by reacting chlorine and carbon monoxide1. In low concentrations, its smell resembles freshly cut grass or hay. It has a suffocating odour and a small amount of phosgene is released in nature from volcanoes. It is mainly produced artificially and is extremely toxic and due to this, it was even used as a chemical weapon during wars. Phosgene is used for deriving a number of chemical compounds used in various industrial sectors. Phosgene is a valued building block and reagent of choice in organic synthesis, in manufacture of dyes, pharmaceuticals, herbicides, insecticides, synthetic foams, resins, and polymers. Diethylcarbamoyl chloride – a derivative of phosgene is used to hydrolyze water insoluble compounds and is extensively used in the pharmaceutical industry.

Industrially, phosgene is produced by passing purified carbon monoxide and chlorine gas through a bed of special porous activated carbon that acts as a catalyst2:

CO + Cl2→ COCl2 (ΔH rxn = -107.6 kJ / mol)

The reaction is exothermic; hence the reactor must be cooled. Typically, the reaction is carried out between 50 and 150°C. Above 200°C, phosgene becomes carbon monoxide and chlorine, Keq (300 K) = 0.05.

Phosgene is highly toxic and symptoms of its inhalation are noticed slowly. It mainly leads to respiratory disorders such as suffocation which is a major constraint for the growth of the phosgene industry.

If this compound is handled with extensive care and all necessary precautions are taken to avoid inhalation, the constraint can be overcome.

Due to safety issues, phosgene is often produced and consumed in the same facility with exceptional measures taken to control and safeguard its use listed in Annex 3 of the Chemical Weapons Convention: All production sites producing more than 30 tons per year must be notified to the OVCW.

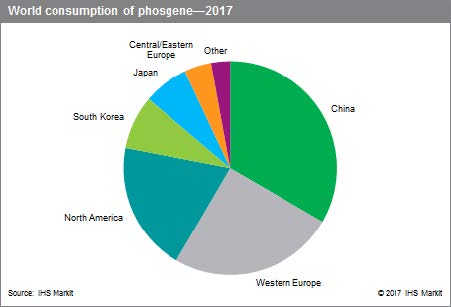

The phosgene industry has been showing continuous growth in the past which is expected to continue in the near future. Western Europe has been the leading consumer of this compound followed by North America and China. China and the Middle East are expected to grow at a better pace due to the increasing demand for phosgene derivatives mainly methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI).

Methylene diphenyl diisocyanate, most often abbreviated as MDI, is an aromatic diisocyanate. Three isomers are common, varying by the positions of the isocyanate groups around the rings: 2,2’-MDI, 2,4’-MDI, and 4,4’-MDI. The 4,4’ isomer is most widely used, and is also known as 4,4’-diphenylmethane diisocyanate. This isomer is also known as Pure MDI. MDI reacts with polyols in the manufacture of polyurethane. It is the most produced diisocyanate, accounting for 61.3% of the global market in the year 2000.

The first step of the production of MDI is the reaction of aniline and formaldehyde, using hydrochloric acid as a catalyst to produce a mixture of diamine precursors, as well as their corresponding polyamines.

Then, these diamines are treated with phosgene to form a mixture of isocyanates, the isomer ratio being determined by the isomeric composition of the diamine.

Distillation of the mixture of isocyanates gives a mixture of oligomeric polyisocyanates, known as polymeric MDI, and a mixture of MDI isomers with a low 2,4’ isomer content. Further purification entails fractionation of the MDI isomer mixture.

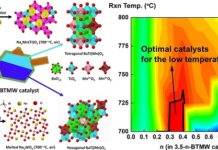

Toluene diisocyanate (TDI) is an organic compound with the formula CH3C6H3(NCO)2. Two of the six possible isomers are commercially important: 2,4-TDI and 2,6-TDI . 2,4-TDI is produced in the pure state, but TDI is often marketed as 80/20 and 65/35 mixtures of the 2,4 and 2,6 isomers, respectively. It is produced on a large scale, accounting for large percentage of the global isocyanate market, second only to MDI. All isomers of TDI are colourless, although commercial samples can appear yellow.

2,4-TDI is prepared in three steps from toluene via. dinitrotoluene and 2,4-diaminotoluene (TDA). Finally, the TDA is subjected to phosgenation, i.e., treatment with phosgene to form TDI. This final step produces HCl as a by-product and is a major source of industrial hydrochloric acid.

Distillation of the raw TDI mixture produces an 80:20 mixture of 2,4-TDI and 2,6-TDI, known as TDI (80/20). Differentiation or separation of the TDI (80/20) can be used to produce pure 2,4-TDI and a 65:35 mixture of 2,4-TDI and 2,6-TDI, known as TDI (65/35).

China is the largest phosgene-producing and consuming country in the world, representing one-third of total demand in 2017. China is expected to be the main consumer of phosgene over the next five years and Chinese demand growth is expected to be about 4% for the next five years. Western Europe follows with approximately 25% of global phosgene production and demand in 2017; it is expected to have average demand growth of almost 3% for the next five years as a result of new capacity starting up and the expansion of specialty isocyanates such as hexamethylene diisocyanate (HDI), which is used in anticorrosive surface coatings for automobiles, aircraft, and trains. The other Asia region is expected to have lower demand for HDI, because of the introduction of new phosgene derivatives in China and other Asian countries. Most Asian countries consume polycarbonate resin; however, because of the expected use of phosgene-free technology, consumption may decrease.

Since phosgene is generated at the plant in which it is consumed, phosgene is linked to the MDI, TDI, and polycarbonate resin–producing industries. Key findings and future implications for the phosgene market include the following:

• The TDI, MDI, and polycarbonate markets are expanding in, or shifting to, the Middle East and China, as well as other Asian countries.

• Changes in the manufacturing processes for polycarbonate resins to phosgene-free technology have moderated the phosgene growth potential in this application.

• Companies are beginning to emerge that specialize in phosgenation technology, that is, phosgene production and reactions, and phosgene derivatives.

The world production of phosgene was estimated at 7.5 billion in 2015. This number is expected to reach 9.7 billion by 2050. Factors such as reduced mortality rate, improved medical facilities, increased lifespan, and reduced infant mortality are augmenting the rise in global population.

The increasing population is driving the demand for basic household necessities such as bedding, cushions, pillow, and upholstered furniture, which are made of flexible PU foams. The wide application of phosgene for manufacturing PU foams is expected to drive the global phosgene market in the future. Of the two major applications, the MDI/PMPPI segment held the largest market share in 2017, accounting for nearly 57% of the market. The market share for this application is expected to increase by 2022. The fastest growing application is TDI, which will account for nearly 27% of the total market share by 2022.

The key global vendors are BASF, Covestro, Huntsman International , Shandong Tianan Chemicals, Van Demark Chemicals, Wanhua Chemical Group. The top four phosgene producing companies are Covestro (24% of global capacity), BASF (19%), Yantai Wanhua (16%), and DowDuPont (9%).

As regards India, Atul Ltd and Paushak Ltd are the only two players in this market. All the manufacturers of Phosgene are situated in Gujarat state alone, also the ‘Chemical Hub’ of India.Paushak is part of the Alembic group of companies situated in Gujarat. Both the companies have several years of safe Phosgene handling and are key vendors for end users for Indian chemical companies.

Indian Phosgene Council was formed in August, 2014, during 3rd International Phosgene Conference organised at Vadodara, Gujarat

In order to maintain the consistency between Indian manufacturers of Phosgene and international phosgene-producing and using companies the Indian Phosgene Council (IPC) was formed to discuss various key issues related to Phosgene safety and knowledge sharing amongst the members, who are manufacturers / consumers of Phosgene. Indian Chemical Council playing the role of a catalyst and streamline the whole of the activities.

The interaction of international groups and associations with Indian industry representatives handling phosgene, di-phosgene, tri-phosgene and isocyanates will set the tone for phosgene safety dialogue between global industry experts and Indian stakeholders. It also becomes an excellent opportunity for regulatory agencies and experts in the emergency preparedness to learn and exchange the emergency response measures / medical emergency response on tested phosgene industry practices globally.

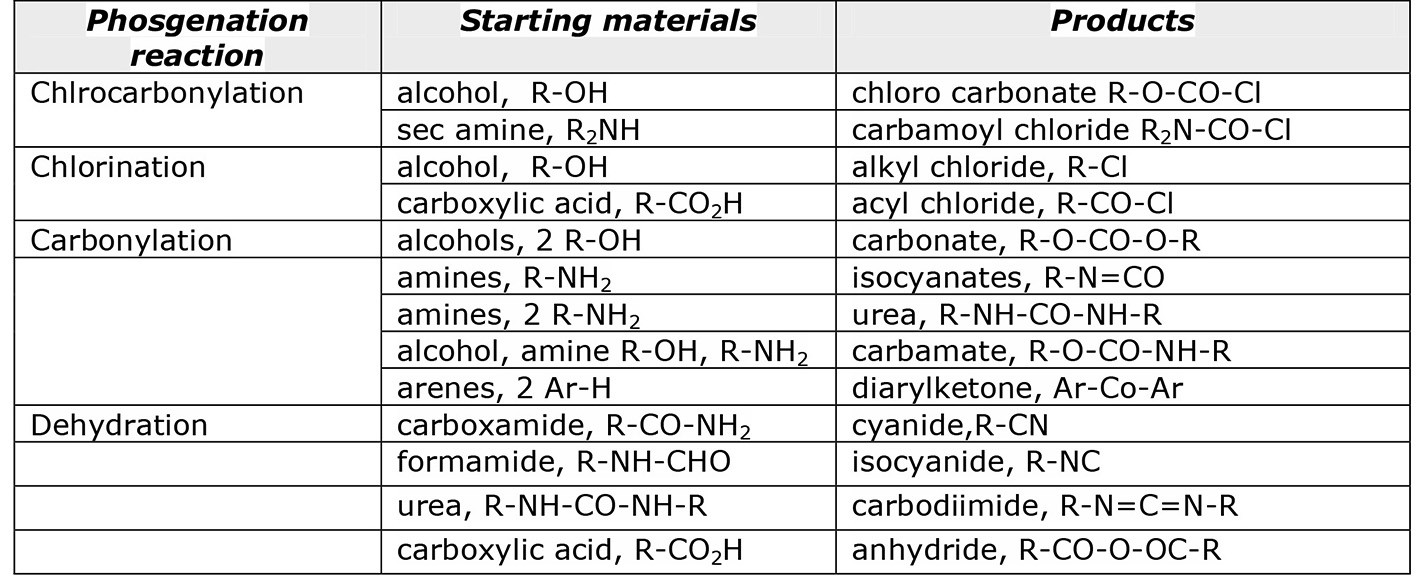

Main phosgenation reactions 3,4 and the versatile products derived from different substrates are depicted in Table 1.

The pie chart shows world consumption of phosgene.

For the high toxicity of phosgene, many safer procedures and substitutes for phosgene have been developed, which will extensively discussed in next issues.

References

1) L. Cotarca, H. Eckert, Phosgenations – a handbook, wiley-vch, weinheim, pp. 1-656 (2004);

2) K.L. Dunlap, Kirk-othmer Encyclopedia of chemical technology, ed. a. seidel, 18, pp. 802-814 (2006);

3) H. Eckert, J. Auerweck, Org. Process Res. Dev., 14, pp.1501-1505 (2010) and references cited therein

4) H. Eckert, Chimica Oggi/Chemistry Today-29(6) November/December2011.